Consolidated Edison, Inc.

4 Irving Place

New York, NY 10003

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x☒

Filed by a party other than the Registrant ¨☐

| Check | the appropriate box: |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Under §240.14a-12 |

CONSOLIDATED EDISON, INC.

(Name of Registrant as Specified In Its Charter)

NOT APPLICABLE

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| No fee required. |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| Fee paid previously with preliminary materials. |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

|

Consolidated Edison, Inc. 4 Irving Place New York, NY 10003 |

Kevin BurkeJohn McAvoy

Chairman of the Board

John McAvoy

President and Chief Executive Officer

April 8, 2014

3, 2017

Dear Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of Consolidated Edison, Inc. We hope that you will join the Board of Directors and the Company’s management at the Company’s Headquarters at 4 Irving Place, New York, New York, on Monday, May 19, 2014,15, 2017, at 10:00 a.m.

The accompanying Proxy Statement, provided to stockholders on or about April 3, 2017, contains information about matters to be considered at the Annual Meeting. At the Annual Meeting, stockholders will be asked to vote on the election of Directors, the ratification of the appointment of independent accountants for 2014, the approval of the Company’s Stock Purchase Plan, and2017, the approval, on an advisory basis, of named executive officer compensation, and the frequency, on an advisory basis, of future advisory votes to approve named executive officer compensation.

Whether or not you plan to attend the Annual Meeting, please vote as soon as possible. It is very important that as many shares as possible be represented at the meeting.

Sincerely,

Sincerely,

|

| John McAvoy |

|

Consolidated Edison, Inc.

4 Irving Place, New York, NY 10003

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| Date: | Monday, May 15, 2017, at 10:00 a.m. | |

|  | |

|

4 Irving Place New York, |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholders:

The Annual Meeting of Stockholders of Consolidated Edison, Inc. will be held at the Company’s Headquarters, 4 Irving Place, New York, New York, on Monday, May 19, 2014, at 10:00 a.m. for the following purposes:

| Items of Business: | a. To elect as the members of the Board of Directors the | |

b. | To ratify the appointment of PricewaterhouseCoopers LLP as independent accountants for |

c. |

| To approve, on an advisory basis, named executive officer compensation; |

d. To conduct an advisory vote on the frequency of future advisory votes on named executive officer compensation; and e. | To transact such other business as may properly come before the meeting, or any adjournment or postponement of the meeting. |

By Order of the Board of Directors,

Jeanmarie Schieler

Vice President and Corporate Secretary

Dated: April 3, 2017

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDERS’ MEETING TO BE HELD ON MONDAY, MAY 15, 2017. THE COMPANY’S PROXY STATEMENT AND ANNUAL REPORT, PROVIDED TO STOCKHOLDERS ON OR ABOUT APRIL 3, 2017, ARE AVAILABLE AT

CONEDISON.COM/SHAREHOLDERS

IMPORTANT!

Whether or not you plan to attend the meeting in person, we urge you to vote your shares of Company Common Stock by telephone, by Internet, or by completing and returning a proxy card or a voter instruction form, so that your shares will be represented at the Annual Meeting.

By Order of the Board of Directors,

Carole Sobin

Vice President and Corporate Secretary

Dated: April 8, 2014

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDERS MEETING TO BE HELD ON MONDAY, MAY 19, 2014

The Company’s Proxy Statement and Annual Report are available at

www.conedison.com/investorreports.annual meeting.

| TABLE OF CONTENTS |

|

SUMMARY | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| PROXY STATEMENT | ||||

| MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING | ||||

| 13 | |||

| 14 | ||||

| THE BOARD OF DIRECTORS | 15 | |||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| STOCK OWNERSHIP AND SECTION 16 COMPLIANCE | 23 | |||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| AUDIT COMMITTEE MATTERS | 25 | |||

| 25 | ||||

| 25 | ||||

| COMPENSATION COMMITTEE REPORT | 26 | |||

| COMPENSATION DISCUSSION AND ANALYSIS | 27 | |||

| 27 | ||||

| 27 | ||||

| 27 | ||||

| 29 | ||||

| PROXY STATEMENT SUMMARY |

PROXY STATEMENT

PROXY MATERIALS

What areThis section highlights the proxy materials?

The proxy materials (“proposals to be acted upon as well as information about Consolidated Edison, Inc. (the “Company”) that can be found in this Proxy Materials”) includeStatement and does not contain all of the following:

Theinformation that you need to consider. Before voting, please carefully review the complete Proxy Statement.

TheStatement and the Annual Report to Stockholders of Consolidated Edison, Inc. (the “Company”),the Company provided to stockholders on or about April 3, 2017, which includes the consolidated financial statements and accompanying notes for the year ended December 31, 2013,2016, and other information relating to the Company’s financial condition and results of operations.

If you received the Proxy Materials by mail, they also include a proxy card or a voter instruction form for use at the 2014 Annual Meeting of Stockholders (the “Annual Meeting”).

Why am I receiving the Proxy Materials?

The Proxy Materials are provided to stockholders of the Company on or about April 8, 2014, in connection with the solicitation of proxies by the Board of Directors of the Company for use at the Annual Meeting and any adjournments or postponements of the Annual Meeting. As a stockholder, you are invited to attend the Annual Meeting and to vote on the items of business described in this Proxy Statement. The Proxy Materials include information that we are required to provide to you under the rules of the Securities and Exchange Commission. We are providing the Proxy Materials to our stockholders by mail, e-mail, or in accordance with the Securities and Exchange Commission’s “Notice and Access” rule.

Why did I receive the Proxy Materials in the mail?

We are providing some of our stockholders, including stockholders who have previously requested to receive paper copies of the Proxy Materials, with paper copies of the Proxy Materials. You may also access the Proxy Materials and vote online at the Internet address provided on the proxy card or the voter instruction form. If you do not want to receive paper copies of proxy materials on an ongoing basis, please follow the instructions for Internet voting on your proxy card or voter instruction form.

Why did I receive e-mail delivery of the Proxy Materials?

We are providing e-mail delivery of the Proxy Materials to those stockholders who have previously elected electronic delivery. Those stockholders should have received an e-mail containing a link to the website where those materials are available and a link to the proxy voting website.

Why did I receive a Notice of Internet Availability of Proxy Materials?

To reduce the environmental impact of our Annual Meeting, we are providing the Proxy Materials over the Internet. As a result, we are sending many of our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) instead of a paper copy of the Proxy Materials. All stockholders receiving the Notice of Internet Availability may access the Proxy Materials over the Internet and request a paper copy of the Proxy Materials by mail. Instructions on how to access the Proxy Materials over the Internet, to vote online, and to request a paper copy may be found in the Notice of Internet Availability. In addition, the Notice of Internet Availability contains instructions on how you may request delivery of proxy materials in printed form by mail or electronically on an ongoing basis.

Can I request a paper copy of the Proxy Statement and Annual Report?

The Company’s Proxy Statement and Annual Report are available on our website atwww.conedison.com/investorreports.A copy of these materials is also available without charge upon written request to the Company’s Vice President and Corporate Secretary at the Company’s principal executive offices at 4 Irving Place, New York, New York 10003.

I share an address with another stockholder, and we received only one copy of the Proxy Materials. How may I obtain an additional copy?

If you are a registered holder of Company Common Stock, Computershare may deliver only one copy of the Proxy Materials or Notice of Internet Availability to multiple stockholders who share an address unless Computershare has received contrary instructions.

If you hold your Company Common Stock through a broker, bank, or other financial institution (“broker”), your broker may deliver only one copy of the Proxy Materials or Notice of Internet Availability to multiple stockholders who share an address unless contrary instructions are received.

The Company will deliver promptly, upon written or oral request, a separate copy of the Proxy Materials or Notice of Internet Availability to a stockholder at a shared address to which a single copy of the documents was delivered.

Stockholders who wish to receive additional copies of the Proxy Materials or Notice of Internet Availability, now or in the future, and stockholders who share an address and wish to receive a single copy of the Proxy Materials or Notice of Internet Availability on an ongoing basis, should submit the request to the Company by telephone (212-460-4322) or by mail to the Company’s Vice President and Corporate Secretary at the Company’s principal offices at 4 Irving Place, New York, New York 10003.

Who pays the cost of soliciting proxies for the Annual Meeting?

The Company will pay the expenses associated with the solicitation of proxies. The solicitation of proxies is being made by mail, telephone, the Internet, facsimile, electronic transmission, or overnight delivery. The expense associated with the solicitation of proxies will include reimbursement for postage and clerical expenses to brokerage houses and other custodians, nominees or fiduciaries for forwarding Proxy Materials and other documents to beneficial owners of stock held in their names. Morrow & Co., LLC, 470 West Avenue, Stamford, CT 06902, has been retained to assist in the solicitation of proxies. The estimated cost of Morrow’s services is $22,000 plus out-of-pocket expenses.

VOTING AND RELATED MATTERS2017 ANNUAL MEETING OF STOCKHOLDERS (“ANNUAL MEETING”)

What is the record date?

The Board of Directors has established March 25, 2014 as the record date for the determination of the Company’s stockholders entitled to receive notice of and to vote at the Annual Meeting.

How many votes do I have?

You are entitled to one vote on each proposal presented at the Annual Meeting for each outstanding share of Company Common Stock you owned on the record date.

How many votes can be cast by all stockholders entitled to vote at the Annual Meeting?

One vote on each proposal presented at the Annual Meeting for each of the 292,901,302 shares of Company Common Stock that were outstanding on the record date.

How many votes must be present to hold the Annual Meeting?

To constitute a quorum to transact business at the Annual Meeting, the holders of a majority of the shares entitled to vote at the Annual Meeting, or 146,450,652, must be present in person or by proxy. We urge you to vote by proxy even if you plan to attend the Annual Meeting, so that we will know as soon as possible that enough votes will be present to hold the meeting. Abstentions and broker non-votes are counted in the determination of the quorum.

How does the Board of Directors recommend that I vote?

| Monday, May 15, 2017, at 10:00 a.m. | |

• Location: | Company Headquarters, 4 Irving Place, New York, NY 10003.

| |

• Record Date & Voting: | Stockholders of record at the close of business on March 21, 2017 are entitled to vote. On the record date, 305,274,517 shares of Company Common Stock were outstanding. Each outstanding share of Common Stock is entitled to one vote. | |

• Admission: | Please follow the instructions contained in “Who Can Attend the Annual Meeting?” and “Do I Need a Ticket to Attend the Annual Meeting?” on page 62. |

| Management Proposals | Board’s Voting Recommendation | Vote Required For Approval* | Page References (for more detail) | |||||

| Proposal No. 1. | Election of | FOR EACH NOMINEE | MAJORITY OF VOTES CAST | 5 to 11 | ||||

Proposal No. 2. | Ratification of the | FOR | MAJORITY OF VOTES CAST | 12 | ||||

Proposal No. 3. | Advisory Vote to Approve | FOR | MAJORITY OF VOTES CAST | 13 | ||||

Proposal No. 4. | Advisory | FOR (1 YEAR) | 14 | |||||

| * | The presence, in person or by proxy, of holders of a majority of the outstanding shares of Company Common Stock is required to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and brokernon-votes (shares held by a broker or nominee that does not have discretionary authority to vote on a particular matter and has not received voting instructions from its clients) are counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting but are not considered votes cast and have no effect on the vote. |

| CONSOLIDATED EDISON, INC. –Proxy Statement | 1 |

What vote is required to approve each item of business?

| PROXY STATEMENT SUMMARY |

The 12 nominees for Director named in this Proxy Statement receiving a majority of the votes cast at the meeting in person or by proxy shall be elected (meaning the number of shares voted “for” a Director nominee must exceed the number of shares voted “against” that Director nominee), subject to the Board’s policy regarding resignations by Directors who do not receive a majority of “for” votes.

The affirmative vote of a majority of the votes cast at the meeting in person or by proxy shall be required to approve the Company’s Stock Purchase Plan. Under New York law, abstentions and broker non-votes, are voted neither “for” nor “against,” and have no effect on the vote. Under New York Stock Exchange rules, approval of this proposal requires the affirmative vote of a majority of votes cast, which includes abstentions, at the meeting in person or by proxy. Thus, under New York Stock Exchange rules, abstentions have the same effect as a vote “against” the Company’s Stock Purchase Plan.

In all other matters, the affirmative vote of a majority of the votes cast at the meeting, in person or by proxy, will be the act of the stockholders.

Except as discussed above, abstentions and broker non-votes are voted neither “for” nor “against,” and have no effect on the vote, but are counted in the determination of the quorum.

How do I vote?

You can vote whether or not you attend the Annual Meeting. Stockholders have a choice of voting over the Internet, by telephone, by mail using a proxy card or voter instruction form, or in person at the Annual Meeting.

If you received a printed copy of the Proxy Materials, please follow the instructions on your proxy card or voter instruction form. Your proxy card or voter instruction form provides information on how to vote over the Internet, by telephone, or by mail.

If you received a Notice of Internet Availability, please follow the instructions on the notice. The Notice of Internet Availability provides information on how to vote over the Internet, by telephone, or by mail.

If you received an e-mail notification, please click on the link provided in the e-mail notification and follow the instructions on how to vote over the Internet or by telephone.

If you are a registered holder of the Company’s Common Stock, you may also vote in person at the Annual Meeting.

To help us reduce the environmental impact of our meeting, we ask that you vote through the Internet or by telephone, both of which are available 24 hours a day. To ensure that your vote is counted, please remember to submit your vote by the date and time indicated on your Notice of Internet Availability, proxy card or voter instruction form, as applicable.

If my shares are held by my broker, can my shares be voted if I don’t instruct my broker?

The Securities and Exchange Commission has approved a New York Stock Exchange rule that affects the manner in which your broker may vote your shares. Your broker may not vote on your behalf for the election of directors or compensation-related matters unless you provide specific voting instructions to your broker. For your vote to be counted, you need to communicate your voting decisions to your broker, in the manner prescribed by your broker, before the date of the Annual Meeting.

If you have any questions about this rule or the proxy voting process in general, please contact the broker where you hold your shares. The Securities and Exchange Commission also has a website (www.sec.gov/spotlight/proxymatters.shtml) with more information about your rights as a stockholder.

If I am a registered holder of Company Common Stock, what if I don’t vote for one or more of the matters listed on my proxy card?

All shares represented by properly executed proxies received in time for the Annual Meeting will be voted at the Annual Meeting in the manner specified by the persons giving those proxies. If you return a signed proxy without indicating voting instructions your shares will be voted as follows:

| • | Proposal No. 1: Election of Directors.The Board of Directors has nominated ten directors for election at the Annual Meeting and recommends the election of each of the |

| Committee Memberships | ||||||||||||||||||

| Name | Primary Occupation | Independent | Audit | Corporate Nominating | Environment, Health and Safety | Executive | Finance | Management and | Operations Oversight | |||||||||

Vincent A. Calarco Director since 2001 | Non-Executive Chairman of Yale New Haven Health System | ✓ | ✓(C) | ✓ | ✓ | ✓ | ||||||||||||

George Campbell, Jr. Director since 2000 | FormerNon-Executive Chairman, Webb Institute | ✓ | ✓ | ✓ | ✓(C) | ✓ | ||||||||||||

Michael J. Del Giudice Director since 1999 | Founder and Senior Managing Director, Millennium Capital Markets LLC | ✓ | ✓ | ✓(C)(L) | ✓ | ✓ | ||||||||||||

Ellen V. Futter Director since 1997 | President, American Museum of Natural History | ✓(C) | ✓ | |||||||||||||||

John F. Killian Director since 2007 | Former Executive Vice President and Chief Financial Officer, Verizon Communications Inc. | ✓ | ✓ | ✓ | ✓ | |||||||||||||

John McAvoy Director since 2013 | Chairman, President and Chief Executive Officer, Consolidated Edison, Inc. | ✓(C) | ||||||||||||||||

Armando J. Olivera Director since 2014 | Former President and Chief Executive Officer, Florida Power & Light Company | ✓ | ✓ | ✓ | ✓ | |||||||||||||

Michael W. Ranger Director since 2008 | Senior Managing Director, Diamond Castle Holdings LLC | ✓ | ✓ | ✓ | ✓(C) | |||||||||||||

Linda S. Sanford Director since 2015 | Former Senior Vice President, Enterprise Transformation, International Business Machines Corporation (IBM) | ✓ | ✓ | ✓ | ✓ | |||||||||||||

L. Frederick Sutherland Director since 2006 | Former Executive Vice President and Chief Financial Officer and Former Senior Advisor to the Chief Executive Officer, Aramark Corporation | ✓ | ✓ | ✓(C) | ✓ | |||||||||||||

✓ = Member (C) = Chair (L) = Lead Director

| • |

|

| • |

|

| • | Proposal No. 4: Advisory Vote on the Frequency of Future Advisory Votes on Named Executive Officer Compensation.The Board recommends a vote, on an advisory basis, to conduct future advisory votes on Named Executive Officer compensation every year. (See “Advisory Vote on the Frequency of Future Advisory Votes on Named Executive Officer Compensation” on page 14.) |

| 2 | CONSOLIDATED EDISON, INC. –Proxy Statement |

| PROXY STATEMENT SUMMARY |

The Company believes that good corporate governance includes proactive stockholder engagement as well as accepting invitations to discuss matters of interest to stockholders. The Company shared with the Board the feedback it received from institutional investors and stockholders following the 2016 proxy season on issues relating to disclosure practices, corporate governance, and environmental, health and safety matters. The Company’s engagement with institutional investors resulted in the Board’s adoption of proxy access, which enables the stockholders of the Company to include their own director nominees in the Company’s Proxy Statement and form of proxy along with candidates nominated by the Board, so long as they meet certain requirements, as set forth in the Company’sBy-laws. (See “The Board of Directors – Proxy Access” on page 15 and “Compensation Discussion and Analysis – Executive Summary – Stockholder Engagement and Say on Pay” on page 29 for additional information.)

| • |

|

Composition. The members of the Board of Directors have the combination of skills, professional experience, and diversity of backgrounds necessary to oversee the Company’s business. Risk Oversight. The Board and its committees oversee the Company’s policies and procedures for managing risks that are identified through the Company’s enterprise risk management program. Membership on Public Company Boards. None of the members of the Board of Directors serve on more than three other public company boards.Can I revoke my proxy or change my vote?• Yes, depending on how your shares of Company Common Stock are held, you may revoke your proxy or change your vote by sending in a new, properly executed proxy card or voter instruction form with a later date, or by casting a new vote by Internet or telephone, or by sending a properly executed written notice of revocation to the Company’s Vice President and Corporate Secretary at the Company’s principal executive offices at 4 Irving Place, New York, New York 10003. Check the instructions on your Notice of Internet Availability, proxy card or voter instruction form for information regarding your specific revocation options. If you are a registered holder of Company Common Stock, you may also change your vote by appearing at the Annual Meeting and voting in person. Attendance at the Annual Meeting without voting will not by itself revoke a proxy.• • ANNUAL MEETING INFORMATIONWhat is the location, date, and time of the Annual Meeting?The Annual Meeting will be held at the Company’s principal executive offices at 4 Irving Place, New York, New York 10003, on Monday, May 19, 2014, at 10:00 a.m.Where can I find directions to the Annual Meeting?Directions to the Annual Meeting are available on our website atwww.conedison.com/investorreports.

Who can attend the Annual Meeting?

Attendance at the Annual Meeting will be limited to holders of Company Common Stock on March 25, 2014, the record date, the authorized representative (one only) of an absent stockholder, and invited guests of management.

Do I need a ticket to attend the Annual Meeting?

Yes, you will need an admission ticket and proof of ownership of Company Common Stock on the record date to enter the meeting.

If you received a printed copy of the Proxy Materials and you are a registered holder of Company Common Stock, your proxy card serves as your admission ticket to the Annual Meeting.

If you received a printed copy of the Proxy Materials and you hold your shares through a broker or through an employee plan, please bring to the Annual Meeting a copy of a brokerage or other statement reflecting your stock ownership as of the record date.

If you received a Notice of Internet Availability, that Notice of Internet Availability serves as your admission ticket to the Annual Meeting.

If you received an e-mail notification, please access the Proxy Materials by clicking on the link provided in the e-mail notification and follow the instructions for downloading a copy of your admission ticket.

If you hold your shares through a broker, you can expedite your admission to the Annual Meeting by registering in advance and printing your admission ticket by visitingwww.proxyvote.com and following the instructions provided (you will need the 12 digit number included on your proxy card, voter instruction form or Notice of Internet Availability).

You may be asked to present valid picture identification to gain entrance to the Annual Meeting. Any person claiming to be an authorized representative of a stockholder must, upon request, produce written evidence of the authorization.

Are there any special attendance procedures?

In order to assure the holding of a fair and orderly meeting and to accommodate as many stockholders as possible who may wish to speak at the Annual Meeting, management will limit the general discussion portion of the meeting and permit only stockholders or their authorized representatives to address the meeting. No signs, banners, placards, handouts, cameras, recording equipment, and similar items may be brought to the meeting room. Many cellular phones have built-in digital cameras, and, while these phones may be brought into the Annual Meeting, the camera function may not be used at any time. Recording of the Annual Meeting is prohibited. Suitcases, briefcases, packages, and other items may be subject to inspection.

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

(Proposal No. 1)

Twelve Directors are to be elected at the Annual Meeting to hold office until the next Annual Meeting and until their respective successors are elected and qualified. (SeeSee “The Board of Directors” on pages 15 to 21.20 for additional information.)

KEY FEATURES OF THE EXECUTIVE COMPENSATION PROGRAM

| Type | Component | Objective | ||

| Performance-Based Compensation | Annual Incentive Compensation | Achievement of financial and operating objectives for which the Named Executive Officers have individual and collective responsibility. | ||

| Long-Term Incentive Compensation | Achievement, over a multi-year period, of financial and operating objectives critical to the performance of the Company’s business plans and strategies. Achievement, over a three-year period, of the Company’s cumulative total shareholder return relative to the Company’s compensation peer group companies. | |||

| Fixed & Other Compensation | Base Salary, Retirement Programs, Benefits and Perquisites | Differentiate base salary based on individual responsibility and performance. Provide retirement and other benefits that reflect the competitive practices of the industry and provide limited and specific perquisites. |

(See “Compensation Discussion and Analysis – Executive Summary” on pages 27 to 28 for additional information.)

CHANGES TO EXECUTIVE COMPENSATION PROGRAM FOR 2017

For 2017, the Management Development and Compensation Committee approved the following changes to the annual incentive plan: • Overall weighting of Other Financial Performance increased from 20% to 25% and the maximum payout for the capital budget component reduced from 200% to 120%. • Overall weighting of the Operating Objectives reduced from 30% to 25% and the maximum payout increased from 175% to 200%. •�� Operating Objectives modified to enhance alignment with the Company’s corporate imperatives – Employee and Public Safety, Environment and Sustainability, Operational Excellence and Customer Experience. |

(See “Compensation Discussion and Analysis – Executive Compensation Actions – Annual Incentive Compensation” on pages 34 to 38 for additional information.)

| CONSOLIDATED EDISON, INC. –Proxy Statement | 3 |

| PROXY STATEMENT SUMMARY |

KEY COMPENSATION GOVERNANCE PRACTICES

| • | Pay Practices. The Company has no employment agreements, no golden parachute excise taxgross-ups, and no individually negotiated equity awards with special treatment upon a change of control. |

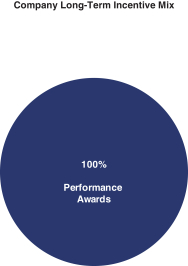

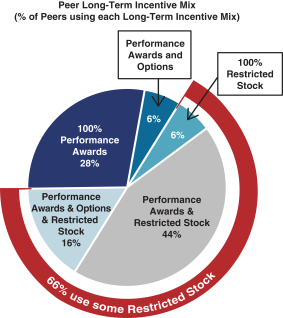

| • | Long-Term Incentive Compensation. The long term incentive plan: (i) prohibits the repricing of stock options or the buyout of underwater options without stockholder approval; (ii) prohibits recycling of shares for future awards except under limited circumstances; (iii) prohibits accelerated vesting of outstanding equity awards except if both a change in control occurs and a participant’s employment is terminated under certain circumstances; and (iv) caps the maximum number of shares that may be awarded to a director, officer, or eligible employee in a calendar year. |

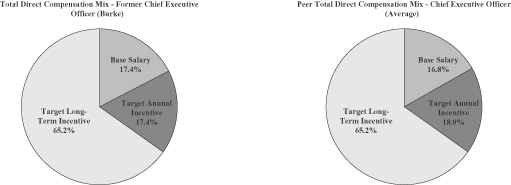

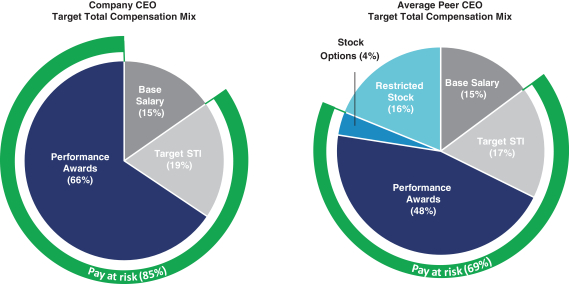

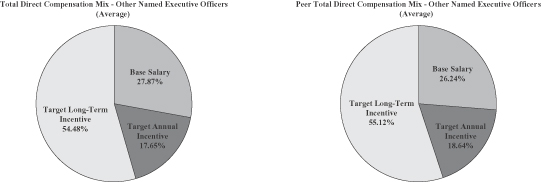

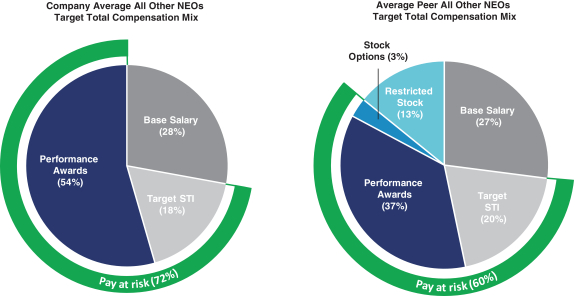

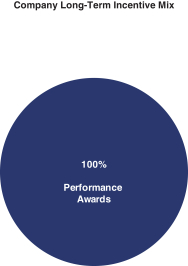

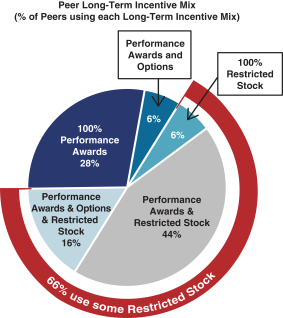

| • | Long-Term Incentive Mix. The following charts illustrate that all Named Executive Officer long-term equity-based incentive compensation is performance-based. As described in proxy statements filed in 2016, over half of the Company’s compensation peer group companies granted some form ofnon-performance-based incentive compensation to their named executive officers: |

|  | |

| • | Risk Management. The Company’s compensation programs include various features that have been designed to mitigate risk. |

| • | Stock Ownership Guidelines. The Company has stock ownership guidelines for directors and certain officers, including the Named Executive Officers. |

| • | No Hedging Nor Pledging. The Company prohibits all Directors, officers, financial personnel, and certain other individuals from shorting, hedging, and pledging Company securities or holding Company securities in a margin account. |

| • | Recoupment Policy. The Company’s compensation recoupment policy (commonly referred to as a “clawback policy”) applies to all officers of the Company and its subsidiaries with respect to incentive-based compensation. |

| • | Annual Advisory Vote to Approve Named Executive Officer Compensation. In 2016, 92.15% of the shares voted were voted to approve the Company’s Named Executive Officer compensation. |

| 4 | CONSOLIDATED EDISON, INC. –Proxy Statement |

| MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING |

PROPOSAL NO. 1 ELECTION OF DIRECTORS

Ten Directors are to be elected at the Annual Meeting to hold office until the next annual meeting and until their respective successors are elected and qualified. (See “Information About the Director Nominees” on pages 6 to 11.) Directors are permitted to stand for election until they reach the mandatory retirement age of 72.75. Of the Board members standing for election, one (John McAvoy)John McAvoy is a currentthe only member who is an officer of the Company. All of the nominees were elected Directors at the last Annual Meeting, other than Mr. McAvoy and Armando J. Olivera. Mr. McAvoy was appointed to the Board of Directors, effective December 26, 2013, at the time his appointment as President and Chief Executive Officer of the Company became effective. Mr. Olivera was elected to the Board of Directors effective February 20, 2014. A professional search firm assisted the Corporate Governance and Nominating Committee in connection with its recommendation of Mr. Olivera.Meeting.

The Company’s management believes that all of the nominees will be able and willing to serve as Directors of the Company. All of the Directors also serve as Trustees of the Company’s

subsidiary, Consolidated Edison Company of New York, Inc. (“Con Edison of New York”). Mr. McAvoy also serves onas Chairman of the Board of the Company’s subsidiary, Orange and Rockland Utilities, Inc. (“Orange & Rockland”).

Gordon J. Davis and Eugene R. McGrath, who served with distinction as Directors of the Company, have reached the mandatory retirement age and therefore will be retiring from the Board effective May 19, 2014, and will not be standing for re-election. The Board has reduced the number of Directors to 12 effective immediately prior to the Annual Meeting.

Shares represented by every properly executed proxy will be voted at the Annual Meeting for or against the election of the Director nominees as specified by the stockholder giving the proxy. If one or more of the nominees is unable or unwilling to serve, the shares represented by the proxies will be voted for any substitute nominee or nominees as may be designated by the Board.

The Board Recommends a Vote FOR Proposal No. 1.

Election of eachEach of the 12ten Director nominees requires the Director tomust receive a majority of the votes cast at the Annual Meeting, in person or by proxy, to be elected (meaning the number of shares voted “for” a Director nominee must exceed the number of shares voted “against” that Director nominee), subject to the Board’s policy regarding resignations by Directors who do not receive a majority of “for” votes. Abstentions and brokernon-votes are voted neither “for” nor “against,” and have no effect on the vote.

| CONSOLIDATED EDISON, INC. –Proxy Statement | 5 |

| MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING |

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT ACCOUNTANTS

(Proposal No. 2)Information About the Director Nominees

At the Annual Meeting, as a matter of sound corporate governance, stockholders will be asked to ratify the selection of PricewaterhouseCoopers LLP (“PwC”) as independent accountants for the Company for the year 2014. If the selection of PwC is not ratified, the Audit Committee will take this into consideration in the future selection of independent accountants.

PwC has acted as independent accountants for the Company for many years. The Audit Committee’s charter provides that at least once every five years, the Audit Committee will evaluate whether it is appropriate to rotate the Company’s independent accountants.

The Audit Committee considered the firm’s qualifications. This included a review of PwC’s performance in prior years, as well as PwC’s reputation for integrity and for competence in the fields of accounting and auditing. The Audit Committee also reviewed a report provided by PwC regarding its quality controls, inquiries or investigations by governmental or professional authorities and independence. (See “REPORT OF THE AUDIT COMMITTEE” and “Fees Paid to PricewaterhouseCoopers LLP” on pages 31 to 32.)

Representatives of PwC will be present at the Annual Meeting and will be afforded the opportunity to make a statement if they desire to do so and to respond to appropriate questions.

The Board Recommends a Vote FOR Proposal No. 2.

Ratification of Proposal No. 2 requires the affirmative vote of a majority of the votes cast on the proposal at the Annual Meeting, in person or by proxy. Abstentions and broker non-votes are voted neither “for” nor “against,” and have no effect on the vote.

APPROVAL OF THE COMPANY’S STOCK PURCHASE PLAN

(Proposal No. 3)

Introduction

The Company’s stockholders are being requested to approve The Consolidated Edison, Inc. Stock Purchase Plan as amended and restated to extend the plan term for an additional ten years and to authorize up to ten million (10,000,000) shares of Company Common Stock for issuance (as amended and restated, the “Stock Purchase Plan”). The Stock Purchase Plan does not reflect any other material amendment as compared to the stock purchase plan approved by the Company’s shareholders in May 2004 (the “Expiring Stock Purchase Plan”). New York Stock Exchange rules require stockholder approval for equity compensation plans such as the Stock Purchase Plan.

The Stock Purchase Plan was considered by the Management Development and Compensation Committee (the “Committee”) of the Board of Directors in consultation with Mercer (US) Inc. (“Mercer”), the Committee’s independent compensation consultant. The Committee recommended that the Board of Directors approve the Stock Purchase Plan and the Board of Directors unanimously approved the Stock Purchase Plan, subject to the approval of the Company’s stockholders at the Annual Meeting.

If approved by the Company’s stockholders at the Annual Meeting, the Stock Purchase Plan will become effective on May 19, 2014.

Timing of Proposal

The Expiring Stock Purchase Plan was approved by the Company’s stockholders at the Annual Meeting on May 17, 2004 and is scheduled to expire on May 17, 2014. If approved by the Company’s stockholders at the Annual Meeting, the Stock Purchase Plan will be scheduled to expire on May 19, 2024.

Description of the Stock Purchase Plan

The following is a summary of the material terms of the Stock Purchase Plan. Capitalized terms used in this summary have the meaning set forth in the Stock Purchase Plan. The complete text of the Stock Purchase Plan is set forth in Appendix A to this Proxy Statement, and stockholders are urged to review it together with the following information, which is qualified in its entirety by reference to Appendix A.

Purpose of the Stock Purchase Plan

The Stock Purchase Plan is a broad-based employee stock purchase plan providing eligible union and management employees and members of the Board of Directors of the Company and its participating affiliates with the opportunity to purchase shares of Company Common Stock. The Stock Purchase Plan provides participants who purchase shares of Company Common Stock under the Stock Purchase Plan with a ten percent discount from the prevailing market price of a share of Company Common Stock through matching contributions from the Company or its participating affiliates (referred to herein as a “Company matching contribution”) equal to 11 percent of a participant’s contribution. (See “Approval of the Company’s Stock Purchase Plan—Company Matching Contributions” on page 10.) Approval of the Stock Purchase Plan will continue to allow purchases of shares of Company Common Stock to be made in a convenient manner, through payroll deductions or cash payments, and without any fees, commissions or charges payable by participants, other than the purchase price.

Term of the Stock Purchase Plan

The maximum term of the Stock Purchase Plan is ten years following approval by the Company’s stockholders, unless an extension of the term is subsequently approved by stockholders. If the Stock Purchase Plan is approved by stockholders at the Annual Meeting, the Stock Purchase Plan will continue until May 19, 2024.

Eligibility and Participation

Employees of the Company and its participating affiliates with more than three months of service are eligible to participate in the Stock Purchase Plan. In addition, members of the Boards of Directors of the Company and its participating affiliates are also eligible. As of December 31, 2013, the eligible participants included approximately 14,000 employees, 11 executive officers of the Company and participating affiliates and 12 non-employee members of the Boards of Directors of the Company and its participating affiliates. As of December 31, 2013, more than 57 percent of employees of the Company and its participating affiliates were participating in the Expiring Stock Purchase Plan.

Available Shares and Investment Limits

The maximum number of shares of Company Common Stock authorized for issuance pursuant to the Stock Purchase Plan is ten million (10,000,000), subject to adjustment by reason of stock split, spinoff, recapitalization, merger, consolidation, or similar corporate transaction that affects shares of Company Common Stock. Eligible participants, other than non-employee members of the Boards of Directors of the Company and its participating affiliates, may invest up to 20 percent of their pay under the Stock Purchase Plan through payroll deductions or cash payments, subject to a maximum amount, excluding dividend reinvestments, of $25,000 during any calendar year. Non-employee members of the Boards of Directors may invest under the Stock Purchase Plan through cash payments, subject to a maximum amount, excluding dividend reinvestments, of $25,000 during any calendar year. The maximum annual benefit under the Stock Purchase Plan available to a participant is $2,778 (excluding dividend reinvestments and brokerage commissions), based on the maximum annual Company matching contribution available to a participant who makes the maximum annual contribution of $25,000. (See “Approval of the Company’s Stock Purchase Plan—Company Matching Contributions” on page 10.) Dividends paid on shares of Company Common Stock held under the Stock Purchase Plan are reinvested in additional shares, unless otherwise directed by the participant.

Source of Shares

Shares of Company Common Stock purchased under the Stock Purchase Plan may be authorized, but unissued, shares or treasury shares purchased directly from the Company by the agent that the Company appoints to administer the Stock Purchase Plan (“New Shares”), or shares purchased by the agent on any securities exchange where shares are traded, in the over-the-counter market, or in negotiated transactions (“Shares Purchased on the Open Market”).

Dilution

Total potential dilution (as a percentage of the 292,872,396 shares of Company Common Stock outstanding as of December 31, 2013) associated with the ten million (10,000,000) shares of Company Common Stock authorized under the Stock Purchase Plan is 3.4 percent. Participants purchased 864,281 shares in 2013 for $49.5 million under the Expiring Stock Purchase Plan (665,718 shares for $39.8 million in 2012 and 721,520 shares for $37.9 million in 2011), including dividend reinvestments. Annual dilution for 2013 was 0.3 percent (0.2 percent in 2012 and 0.3 percent in 2011). Annual dilution equals shares purchased divided by the number of shares of Company Common Stock outstanding at the beginning of the year. The actual dilution associated with the shares of Company Common Stock to be issued under the Stock Purchase Plan prior to its scheduled termination on May 19, 2024 is not determinable at this time, and will depend on the amounts invested by participants and the purchase price of the shares at various future dates. In addition, the Company may from time to time determine whether shares purchased under the Stock Purchase Plan will be Shares Purchased on the Open Market (which would not be dilutive) or New Shares. Potential dilution amount is a forward-looking statement. Forward-looking statements are not facts. Actual results may differ materially because of factors such as those identified in reports the Company files with the Securities and Exchange Commission.

Purchase Price of Shares

The purchase price of shares of Company Common Stock under the Stock Purchase Plan is dependent upon the source of the shares. For New Shares, the price for a given month is the average of the high and low prices at which shares of Company Common Stock were traded on the New York Stock Exchange on the trading day immediately preceding the purchase dates occurring during a given month. For Shares Purchased on the Open Market, the purchase price of the shares of Company Common Stock for a given month is the average cost, exclusive of brokerage commissions and other expenses, of all shares purchased by the Stock Purchase Plan’s agent during the month. All brokerage commissions and other expenses incurred by the Stock Purchase Plan’s agent in the purchase of shares under the Stock Purchase Plan are paid by the Company or its participating affiliates and are not included in the cost of the shares to the participant.

Company Matching Contributions

To provide a ten percent discount for purchases under the Stock Purchase Plan, the Company or its participating affiliates contribute an amount equal to one-ninth of the amount invested by each participant (including dividend reinvestments)—$1 for each $9 invested. The maximum Company matching contribution available to a participant annually is $2,778 (excluding dividend reinvestment and brokerage commissions), which is available to participants who make the maximum annual contribution of $25,000. (See “Approval of the Company’s Stock Purchase Plan—Available Shares and Investment Limits” on page 9.)

Holding Period

A participant may at any time withdraw or dispose of shares of Company Common Stock held under the Stock Purchase Plan. However, if the shares have been held for less than one year, the participant is ineligible to make further investments under the Stock Purchase Plan (including dividend reinvestments) until the first day of the 13th calendar month following the calendar month during which the shares were purchased.

Modification and Termination of the Stock Purchase Plan

The Company reserves the right and power to suspend, terminate, amend or otherwise modify the Stock Purchase Plan; provided, however, that no suspension, termination, amendment or modification will restrict the right of any participant to withdraw all full shares held under the Stock Purchase Plan, and to receive the net proceeds, after expenses of sale, of any fractional shares held. Any amendment or other modification of the Stock Purchase Plan would, under the New York Stock Exchange listing standards, require stockholder approval if the amendment or modification constituted a material revision under the listing standards.

Other

The Stock Purchase Plan is not a qualified “employee stock purchase plan” under Sections 423 or 401(a) of the Internal Revenue Code and is not subject to the provisions of the Employee Retirement Income Security Act of 1974.

Plan Benefits

It is not presently possible to determine, with respect to the persons and groups shown in the table below, the number of shares to be purchased in the future by such person or groups pursuant to the Stock Purchase Plan. Therefore, the following table sets forth information pertaining to shares which have been purchased during 2013 pursuant to the Expiring Stock Purchase Plan.

Stock Purchase Plan Benefits(1)

| Dollar Value | Number of Shares | |||||||

John McAvoy | $ | 2,478 | 43.29 | |||||

Robert Hoglund | $ | 4,146 | 72.35 | |||||

Craig Ivey | $ | 3,226 | 56.13 | |||||

William Longhi | $ | 0 | 0 | |||||

Elizabeth D. Moore | $ | 3,217 | 55.97 | |||||

Kevin Burke | $ | 0 | 0 | |||||

Non-NEO Executive Group | $ | 10,576 | 184.05 | |||||

Non-Executive Director Group | $ | 335 | 5.92 | |||||

Non-Executive Officer Employee Group(2) | $ | 1,095,926 | 19,383.03 | |||||

Footnotes:

U.S. Federal Income Tax Consequences

The following is a general summary as of the date of this Proxy Statement of the U.S. federal income tax consequences associated with the Stock Purchase Plan and is not intended to address state or local tax consequences. The federal tax laws are complex and subject to change and the tax consequences for any participant will depend on his or her individual circumstances. Participants are advised to consult their individual tax advisors concerning the tax implications of participation in the Stock Purchase Plan.

Company Matching Contributions. The aggregate amount of Company matching contributions contributed to a participant’s account under the Stock Purchase Plan in each year will constitute taxable wage income to the participant in the given year. The Company will be entitled to a deduction for amounts contributed by the Company and its participating affiliates with respect to a given year.

Dividends. Dividends, which are paid on shares of Company Common Stock purchased by a participant under the Stock Purchase Plan, will constitute taxable income to the participant in the year of payment, even if the dividends are reinvested and not distributed to the participant. The Company will not be entitled to a deduction for dividends paid with respect to the shares.

Taxes Upon Disposition of Shares. Any gain or loss realized by a participant upon disposition of shares of Company Common Stock purchased under the Stock Purchase Plan will constitute either long-term or short-term gain or loss to a participant in connection with the sale or exchange of a capital asset depending on the holding period. The gain or loss for a share will be the difference between the price the participant received upon disposition of the share and the purchase cost of the share as reported to a participant. The Company will not be entitled to a deduction upon disposition of the shares.

Equity Compensation Plan Information

The following table sets forth, as of December 31, 2013, certain information about the Company’s equity compensation plans.

Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |||||||||

| (a) | (b) | (c) | ||||||||||

Equity compensation plans approved by security holders | ||||||||||||

2003 LTIP(1) | 2,297,545 | $ | 43.383 | — | ||||||||

2013 LTIP(2) | 19,760 | — | 4,980,240 | |||||||||

Total equity compensation plans approved by security holders | 2,317,305 | — | 4,980,240 | |||||||||

Total equity compensation plans not approved by security holders | 5,000 | (3) | — | — | ||||||||

|

|

|

|

|

| |||||||

Total | 2,322,305 | — | 4,980,240 | (4) | ||||||||

|

|

|

|

|

| |||||||

Footnotes

The Board Recommends a Vote FOR Proposal No. 3.

Approval of Proposal No. 3 requires the affirmative vote of a majority of the votes cast on the proposal at the Annual Meeting, in person or by proxy. Under New York law, abstentions and broker non-votes are voted neither “for” nor “against,” and have no effect on the vote. Under New York Stock Exchange rules, approval of this proposal requires the affirmative vote of a majority of votes cast, which includes abstentions, at the meeting in person or by proxy. Thus, under New York Stock Exchange rules, abstentions have the same effect as a vote “against” the Stock Purchase Plan.

ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION

(Proposal No. 4)

The Company values the opinions of our stockholders, and in accordance with Section 14A of the Securities Exchange Act of 1934, the stockholders may vote to approve, on an advisory basis, the compensation of the Company’s Named Executive Officers. The Board recommends that the stockholders vote to approve, on an advisory basis, the compensation of the Company’s Named Executive Officers, as disclosed in the Compensation Discussion and Analysis (“CD&A”) section, and the related compensation disclosure tables on pages 33 to 64. The Company currently conducts such votes annually. In 2013, the Company held a “say-on-pay” vote to approve the Company’s Named Executive Officer compensation, as set forth in the 2013 proxy statement, and 90.20 percent of the shares voted were voted “for” the proposal. Following this year’s vote, the next such vote will be at the Company’s 2015 annual meeting of stockholders.

As discussed in the CD&A, the Company’s executive compensation program is designed to assist in attracting and retaining key executives critical to the Company’s long-term success, and to motivate these executives to create value for its stockholders and to provide reliable service for its customers. The Management Development and Compensation Committee (the “Compensation Committee”), with the assistance of its independent compensation consultant, seeks to provide base salary, target annual incentive awards, and target long-term incentive award values that are competitive with the median level of compensation provided by the Company’s compensation peer group. (See “Committee Actions with Respect to Executive Compensation—Compensation Peer Group” on page 40.)

The Compensation Committee believes that performance-based variable compensation should represent the most significant portion of each Named Executive Officer’s total direct compensation to motivate strong annual and multi-year Company performance. Additionally, the Compensation Committee believes that most of the performance-based variable compensation should be in the form of long-term, rather than annual incentives, to emphasize the importance of sustained Company performance. Each year, the Compensation Committee evaluates the level of compensation and the mix of base salary and performance-based variable compensation of each Named Executive Officer to ensure that it meets the Compensation Committee’s objectives and is competitive with levels of compensation of the compensation peer group.

The Compensation Committee chooses performance measures under the annual incentive plan and the long term incentive plan to support the Company’s short- and long-term business plans and strategies. In setting targets for the short- and long-term performance measures, the Compensation Committee considers the Company’s annual and long-term business plans and certain other factors, including pay-for-performance alignment, economic and industry conditions, and the practices of the compensation peer group. The Compensation Committee sets challenging, but achievable, goals for the Company and its executives to drive the achievement of short- and long-term objectives.

The Compensation Committee, in consultation with its independent compensation consultant, introduced changes for 2014 for the performance restricted stock units granted to certain executive officers, including the Named Executive Officers other than Mr. Burke (who retired as an executive officer in 2013), for the 2014-2016 performance period. The Compensation Committee removed “Incentive Plan Percentage” (the average calculated payout under the Company’s annual incentive plan over the three-year performance period) as a performance measure because it used the same performance measures as the annual incentive plan. The Compensation Committee replaced “Incentive Plan Percentage” with a target for (i) cumulative adjusted earnings per share during the three-year performance period, which focuses on the creation of long-term shareholder value through improving after-tax profitability, and (ii) certain operating objectives for the period (long-term system reliability and environmental sustainability), which are important to the Company’s operating effectiveness and are closely aligned with its business goals. The Compensation Committee will continue to use “Shareholder Return Percentage” (the cumulative change in Company total shareholder returns over the three-year performance period compared with the Company’s compensation peer group as constituted on the date the performance restricted stock units are granted) as a performance measure. Awards to the Company’s executive officers, including the

Named Executive Officers, under the long term incentive plan will continue to be completely performance based applying pre-established performance measures. (See “Executive Summary of the Executive Compensation Program—2014 Performance Restricted Stock Unit Awards” on pages 35 to 36.)

For the reasons highlighted above and more fully discussed in the CD&A, the Board recommends that the stockholders vote in favor of the following resolution:

“RESOLVED, That the compensation paid to the Company’s Named Executive Officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion is hereby approved.”

The Board Recommends a Vote FOR Proposal No. 4.

Approval of Proposal No. 4 requires the affirmative vote of a majority of the vote cast on the proposal at the Annual Meeting, in person or by proxy. Abstentions and broker non-votes are voted neither “for” nor “against,” and have no effect on the vote.

The Board values the opinions of the Company’s stockholders as expressed through their vote and other communications. Although the vote is on an advisory basis, the Board and its Compensation Committee will consider the voting results when making future compensation decisions for the Company’s Named Executive Officers.

Information About the Nominees

The Board and the Corporate Governance and Nominating Committee consider the qualifications of Directors and Director candidates individually and in the broader context of the Board’s overall composition and the Company’s current and future needs. The Board believes that the Board, as a whole, should possess a combination of skills, professional experience, and diversity of backgrounds necessary to oversee the Company’s business. The Board has adopted Corporate Governance Guidelines to assist it in exercising its responsibilities to the Company and its stockholders. In evaluating Director candidates and considering incumbent Directors for renomination to the Board, the Board and the Corporate Governance and Nominating Committee consider various factors. Pursuant to the Guidelines, the Corporate Governance and Nominating Committee reviews with the Board the skills and characteristics of Director nominees, including independence, integrity, judgment, business

experience, areas of expertise, availability for service, factors relating to the composition of the Board (including its size and structure), and the Company’s principles of diversity. For incumbent Directors, the Corporate Governance and Nominating Committee also considers past performance of the Director on the Board.

The current Director nominees bring to the Company the benefit of their qualifications, leadership, skills, and the diversity of their experience and backgrounds as set forth below, which provide the Board, as a whole, with the skills and expertise that reflect the needs of the Company’s regulated utilities and competitive energy businesses. Below,Company. See pages 6 to 11 for information about each Director nominee, isincluding their age as of the date of the Annual Meeting, business experience, period of service as a Director, public or investment company directorships, during the past five years, and other directorships.

| 6 | ||

| ||

| ||

| ||

| ||

| ||

| ||

Vincent A. Calarco | ||

| Director since: 2001 Age: 74 Board • Audit (Chair) • Corporate Governance and Nominating • Executive • Management Development and Compensation | |

Career Highlights: Mr. Calarco has been theNon-Executive Chairman of Yale New Haven Health System since October 2016. Mr. Calarco was theNon-Executive Chairman of Newmont Mining Corporation, Denver, CO, a gold production company, from January 2008 to April 2016. From April 1985 to July 2004, Mr. Calarco was Chairman, President and Chief Executive Officer of Crompton Corporation (now known as Chemtura Corporation). Chemtura is a global specialty chemicals company, headquartered in Philadelphia, PA. Mr. Calarco also held various management and executive positions at Uniroyal Chemical Company.

Other Directorships: Mr. Calarco is a Trustee of Con Edison of New York and a Director of Newmont Mining Corporation. During the past five years, Mr. Calarco also served as a Director of CPG International, Inc. through October 2013. Mr. Calarco is also the President and a Trustee of the Hopkins School, and a Director or Trustee of Swanson Industries, Yale New Haven Health System andYale-New Haven Hospital.

Attributes and Skills: Mr. Calarco has experience leading public companies, and has management and executive experience with manufacturing companies. Mr. Calarco’s experience from his leadership positions and financial oversight experience in senior management roles at Newmont Mining Corporation and Crompton Corporation and his service on other boards support the Board in its oversight of the Company’s management, financial, operations, and strategic planning activities.

|

| |

| Director since: 2000 Age: 71 Board • Corporate Governance and Nominating • Executive • Management Development and | |

| Compensation (Chair) • Operations Oversight | |

Career Highlights: Dr. Campbell, a physicist, was theNon-Executive Chairman of the Webb Institute, Glen Cove, NY, an all scholarship college offering degrees exclusively in naval architecture and marine engineering, from November 2012 to October 2016. Dr. Campbell was the President of The Cooper Union for the Advancement of Science and Art, New York, NY, a college focusing primarily on engineering, architecture, and art, from July 2000 to June 2011. Dr. Campbell also held various management positions at AT&T Bell Laboratories. Dr. Campbell also served as President and Chief Executive Officer of NACME, Inc., anon-profit corporation focused on engineering education and science and technology policy.

Other Directorships: Dr. Campbell is a Trustee of Con Edison of New York and a Director of Barnes and Noble, Inc. Dr. Campbell is also a Director or Trustee of the Josiah Macy Foundation, The Mitre Corporation, Montefiore Medical Center, Rensselaer Polytechnic Institute, the U.S. Naval Academy Foundation and the Webb Institute.

Attributes and Skills: Dr. Campbell has experience leading premiere colleges and anon-profit corporation, with a focus on engineering and science. Dr. Campbell also has experience in management and research and development at a public company. Dr. Campbell’s experience from his leadership positions at Webb Institute, The Cooper Union for the Advancement of Science and Art, AT&T Bell Laboratories, and NACME, Inc., and his service on other boards support the Board in its oversight of the Company’s operations and management activities.

| CONSOLIDATED EDISON, INC. –Proxy Statement | ||

| ||

|

| |

| ||

| ||

| ||

|

Director since: 1999 Age: 74 Board Committees: • Audit • Corporate Governance and Nominating (Chair & Lead Director) • Executive • Management Development and Compensation |

Career Highlights: Mr. Del Giudice is the founder and Senior Managing Director of Millennium Capital Markets LLC, New York, NY, an investment banking firm since 1996, and Chairman of Carnegie Hudson Resources, LLC, a private equity firm. Mr. Del Giudice was a General Partner at the investment bank of Lazard Frères & Co., and served as Chief of Staff to New York State Governor Mario Cuomo, Director of State Operations to New York State Governor Hugh Carey, and Chief of Staff to the New York State Assembly Speaker Stanley Steingut.

Other Directorships: Mr. Del Giudice is a Trustee of Con Edison of New York and a Director of Fusion Telecommunications International, Inc. During the past five years, Mr. Del Giudice also served as a Director of Reis, Inc. through September 2013. Mr. Del Giudice also served as Lead Director of Barnes and Noble, Inc. through September 2010. Mr. Del Giudice is Acting Chair of the New York Racing Association, and a Director of Bloomfield Industries, Corinthian Capital Group, and Universal Marine Medical Supply International LLC.

Attributes and Skills: Mr. Del Giudice has experience in private equity, with a focus on the power and energy infrastructure market, as well as experience in government service. Mr. Del Giudice’s experience from his investment activities and his government service support the Board in its oversight of the Company’s corporate governance, financial, and strategic planning activities, and the Company’s relationships with stakeholders.

| Ellen V. Futter Director since: 1997 Age: 67 Board Committees: • Environment, Health and Safety (Chair) • Operations Oversight |

Career Highlights: Ms. Futter has been the President of the American Museum of Natural History, New York, NY, since November 1993. Previously, Ms. Futter served as the President of Barnard College, New York, NY, and as the Chairman of the Federal Reserve Bank of New York, and was a corporate attorney at the law firm of Milbank, Tweed, Hadley & McCloy.

Other Directorships: Ms. Futter is a Trustee of Con Edison of New York. During the past five years, Ms. Futter also served as a Director of JPMorgan Chase & Co., Inc. through July 2013. Ms. Futter is also a Director or Trustee of NYC & Company and the Brookings Institution and a Manager at the Memorial Sloan-Kettering Cancer Center.

Attributes and Skills: Ms. Futter has management and operations experience leading major New Yorknot-for-profit entities that provide services to the public. Ms. Futter also has legal and financial experience. Ms. Futter’s experience from her leadership positions at the American Museum of Natural History and Barnard College, and her legal experience support the Board in its oversight of the Company’s operations, planning and regulatory activities and the Company’s relationships with stakeholders.

| 8 | CONSOLIDATED EDISON, INC. –Proxy Statement |

| MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING |

| John F. Killian Director since: 2007 Age: 62 Board Committees: • Audit • Corporate Governance and Nominating • Management Development and Compensation |

Career Highlights:Mr. Killian was the Executive Vice President and Chief Financial Officer of Verizon Communications Inc., a telecommunications company, from March 2009 to December 2010. Mr. Killian was the President of Verizon Business, Basking Ridge, NJ, from October 2005 until February 2009, the Senior Vice President and Chief Financial Officer of Verizon Telecom from June 2003 until October 2005, and the Senior Vice President and Controller of Verizon Telecom from April 2002 until June 2003. Mr. Killian also served in executive positions at Bell Atlantic and was the President and Chief Executive Officer of NYNEX CableComms Limited.

Other Directorships: Mr. Killian is a Trustee of Con Edison of New York and Goldman Sachs Trust II and a Director of Houghton Mifflin Harcourt Company. Mr. Killian is also a Trustee of Providence College.

Attributes and Skills: Mr. Killian has leadership experience at regulated consumer services companies, including experience with financial reporting and internal auditing. Mr. Killian’s experience from his leadership positions at Verizon Communications, Inc., Bell Atlantic and NYNEX CableComms Limited supports the Board in its oversight of the Company’s auditing, financial, operating, and strategic planning activities, and the Company’s relationships with stakeholders.

| John McAvoy Director since: 2013 Age: 56 Board Committee: • Executive (Chair) |

Career Highlights: Mr. McAvoy has been Chairman of the Board of the Company and Con Edison of New York since May 2014. Mr. McAvoy has been President and Chief Executive Officer of the Company and Chief Executive Officer of Con Edison of New York since December 2013. Mr. McAvoy was President and Chief Executive Officer of Orange & Rockland from January 2013 to December 2013. Mr. McAvoy was Senior Vice President of Central Operations for Con Edison of New York from February 2009 to December 2012. Mr. McAvoy joined Con Edison of New York in 1980.

Other Directorships: Mr. McAvoy is a Trustee of Con Edison of New York. Mr. McAvoy is also a Director or Trustee of the American Gas Association, the Edison Electric Institute, the Intrepid Sea, Air and Space Museum, the Mayor’s Fund to Advance New York City, New York State Energy Research and Development Authority, and the Partnership for New York City. Mr. McAvoy is also Chair of the Electricity Information Sharing and Analysis Center Executive Committee and Orange & Rockland.

Attributes and Skills: Mr. McAvoy has leadership, engineering, financial, and operations experience, as well as knowledge of the utility industry and the Company’s business. Mr. McAvoy’s experience from his leadership positions at the Company, and his service on other boards, supports the Board in its oversight of the Company’s management, financial, operations, and strategic planning activities, and the Company’s relationships with stakeholders.

| CONSOLIDATED EDISON, INC. –Proxy Statement | 9 |

| MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING |

| Armando J. Olivera Director since: 2014 Age: 67 Board Committees: • Environment, Health and • Finance • Operations Oversight |

Career Highlights: Mr. Olivera was President of the utility industry. Mr. Olivera’s experience from his leadership positions at Florida Power & Light Company, an electric utility that is a subsidiary of a publicly traded energy company, and his service on other boards, supports the Board in its oversight of the Company’s management, financial, operations, and strategic planning activities. Mr. Olivera was President of Florida Power & Light Company from June 2003, and Chief Executive Officer from July 2008, until his retirement in May 2012. Mr. Olivera joined Florida Power & Light Company in 1972. Mr. Olivera also served as Chairman of the Boards of twonon-profits: Florida Reliability Coordinating Council that focuses on the reliability and adequacy of bulk electricity in Florida, and Southeastern Electric Exchange that focuses on coordinating storm restoration services and enhancing operational and technical resources.

Other Directorships: Mr. Olivera is a Trustee of Con Edison of New York. Mr. Olivera also serves as a Director of Fluor Corporation and Lennar Corporation. During the past five years, Mr. Olivera served as a Director of AGL Resources, Inc. until July 2016, and as a Director of Florida Power & Light Company until his retirement in May 2012. Mr. Olivera joined Florida Power & Light Company in 1972.Mr. Olivera has been a Director of the Company and a Trustee of Con Edison of New York since February 2014. Mr. Olivera serves as a Director of Fluor Corporation and AGL Resources, Inc. (and had served as a director of Nicor, Inc. prior to its merger in 2011 with AGL Resources, Inc.). During the past five years, Mr. Olivera served as a Director of Florida Power & Light Company through May 2012. Mr. Olivera is also a Trustee of Cornell University Florida Reliability Coordinating Council, Inc., and Miami Dade College.

Attributes and Skills: Mr. Olivera has leadership, engineering, and operations experience, as well as knowledge of the utility industry. Mr. Olivera’s experience from his leadership positions at Florida Power & Light Company, and his service on other boards, supports the Board in its oversight of the Company’s management, financial, operations, and strategic planning activities.

| Michael W. Ranger Director since: 2008 Age: 59 Board Committees: • Audit • Finance • Operations Oversight (Chair) |

Career Highlights: Mr. Ranger has been Senior Managing Director of Diamond Castle Holdings LLC, New York, NY, a private equity investment firm, since 2004 andNon-Executive Chairman of KDC Solar LLC since 2010. Mr. Ranger was an investment banker in the energy and power sector for twenty years, including at Credit Suisse First Boston, Donaldson, Lufkin and Jenrette, DLJ Global Energy Partners, and Drexel Burnham Lambert. Mr. Ranger was also a member of the Utility Banking Group at Bankers Trust.

Other Directorships: Mr. Ranger is a Trustee of Con Edison of New York and a Director of Covanta Holding Corporation. Mr. Ranger is also a Director or Trustee of Bonten Media Group, KDC Solar LLC, Morristown-Beard School, Professional Direction Enterprise, Inc., and St. Lawrence University.

Attributes and Skills: Mr. Ranger has investment experience focusing on the energy and power sector, investment banking experience in the energy and power sector, and experience as a member of a utility banking group. Mr. Ranger’s experience from his investment activities in the energy and power sector supports the Board in its oversight of the Company’s financial and strategic planning activities.

| 10 | CONSOLIDATED EDISON, INC. –Proxy Statement |

| MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING |

| Linda S. Sanford Director since: 2015 Age: 64 Board Committees: • Corporate Governance and Nominating • Environment, Health and Safety • Finance |

Career Highlights: Ms. Sanford was Senior Vice President Enterprise Transformation, International Business Machines Corporation (IBM), a multinational technology and consulting corporation, from January 2003 to December 2014. Ms. Sanford joined IBM in 1975.

Other Directorships: Ms. Sanford is a Trustee of Con Edison of New York and a Director of Pitney Bowes Inc., RELX NV (formerly Reed Elsevier NV) and RELX PLC (formerly Reed Elsevier PLC). During the past five years, Ms. Sanford served as a Director of ITT Corporation through May 2013. Ms. Sanford is also a Director or Trustee of ION Group and New York Hall of Science.

Attributes and Skills: Ms. Sanford has leadership experience at an international technology company, including experience with information technology, manufacturing, customer relations, and corporate planning. Ms. Sanford’s experience from her leadership positions at IBM and her service on other boards supports the Board in its oversight of technology, relationship with stakeholders, and financial and strategic planning activities.

| L. Frederick Sutherland Director since: 2006 Age: 65 Board Committees: • Audit • Finance (Chair) • Management Development and Compensation |

Career Highlights: Mr. Sutherland was the Executive Vice President and Chief Financial Officer of Aramark Corporation, Philadelphia, PA, a provider of services, facilities management and uniform and career apparel, from 1997 through April 2015 and the Senior Advisor to the Chief Executive Officer from April 2015 to December 2015. Prior to joining Aramark in 1980, Mr. Sutherland was Vice President in the Corporate Banking Department of Chase Manhattan Bank, New York, NY.

Other Directorships: Mr. Sutherland is a Trustee of Con Edison of New York and a Director of Colliers International Group Inc. Mr. Sutherland is also a Director or Trustee of People’s Light and Theater and Sterling Talent Solutions. Mr. Sutherland is also Chairman of the Board of WHYY, a PBS affiliate.

Attributes and Skills: Mr. Sutherland has leadership experience at an international managed services company, including experience with financial reporting, internal auditing, mergers and acquisitions, financing, risk management, corporate compliance, and corporate planning. Mr. Sutherland also has corporate banking experience. Mr. Sutherland’s experience from his leadership positions at Aramark Corporation and Chase Manhattan Bank supports the Board in its oversight of the Company’s financial reporting, auditing, and strategic planning activities.

| CONSOLIDATED EDISON, INC. –Proxy Statement | 11 |

| MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING |

PROPOSAL NO. 2 RATIFICATION OF THE APPOINTMENT OF INDEPENDENT ACCOUNTANTS

At the Annual Meeting, as a matter of sound corporate governance, stockholders will be asked to ratify the Audit Committee’s appointment of PricewaterhouseCoopers LLP (“PwC”) as independent accountants for the Company for 2017. If the appointment of PwC is not ratified, the Audit Committee will take this into consideration in the future appointment of independent accountants.

PwC has acted as independent accountants for the Company for many years. The Audit Committee considered PwC’s qualifications in determining whether to appoint PwC as independent accountants for 2017. The Audit Committee reviewed PwC’s performance, as well as PwC’s reputation for

integrity and for competence in the fields of accounting and auditing. The Audit Committee also reviewed a report provided by PwC regarding its quality controls, inquiries or investigations by governmental or professional authorities and independence. (See “Audit Committee Matters” on page 25.) Based on this review, the Audit Committee believes that the appointment of PwC as independent accountants for the Company for 2017 is in the best interests of the Company and its stockholders.

Representatives of PwC will be present at the Annual Meeting and will be afforded the opportunity to make a statement if they desire to do so and to respond to appropriate questions.

The Board Recommends a Vote FOR Proposal No. 2.

Ratification of Proposal No. 2 requires the affirmative vote of a majority of the votes cast on the proposal at the Annual Meeting, in person or by proxy. Abstentions and brokernon-votes are voted neither “for” nor “against,” and have no effect on the vote.

| 12 | CONSOLIDATED EDISON, INC. –Proxy Statement |

| MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING |

PROPOSAL NO. 3 ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION